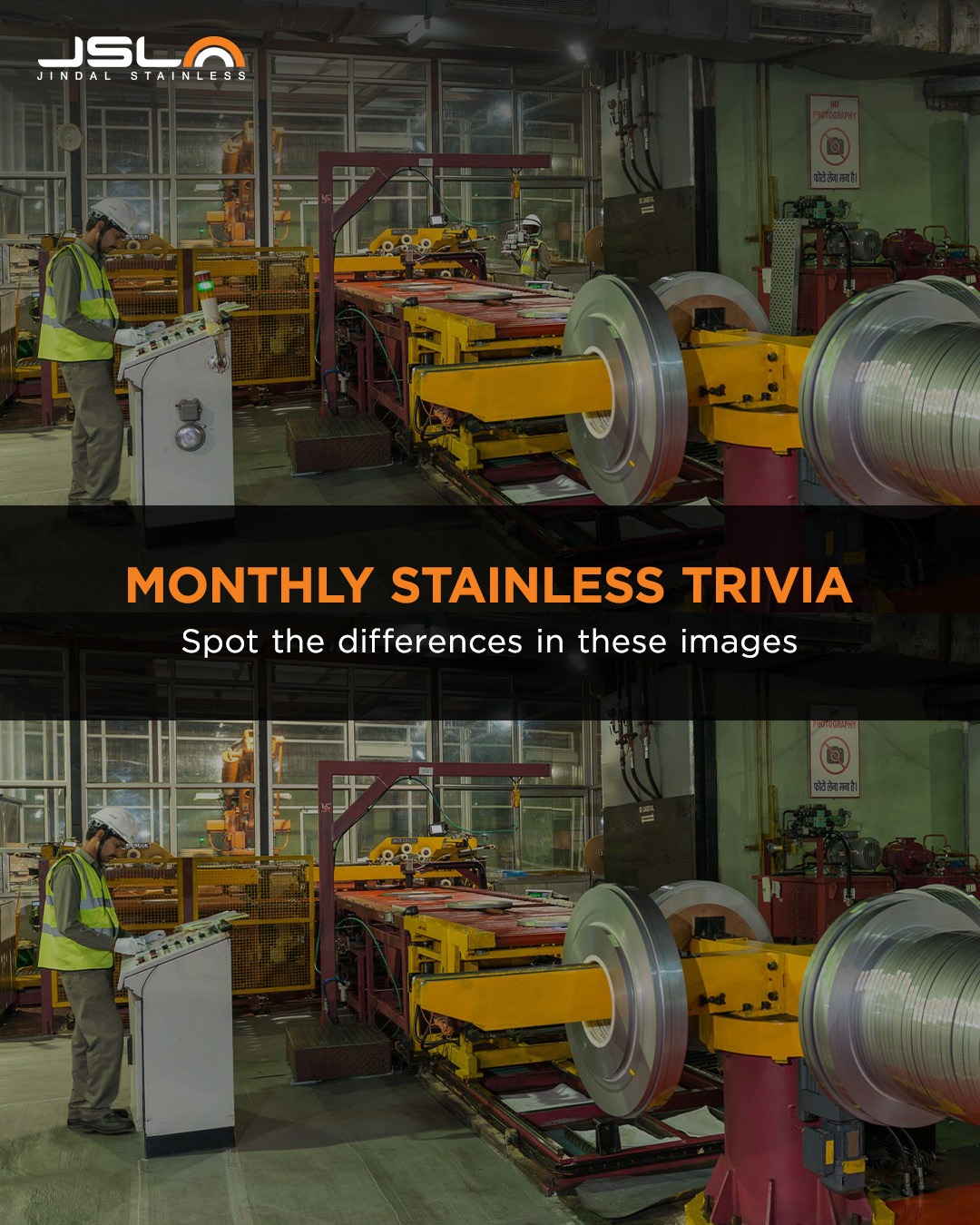

Monthly

Stainless Trivia

Fill in your answer below

| Q4FY23 and FY23 Highlights |

|---|

| Standalone performance in Q4FY23: Sales Volume at 507,632 MT, up by 8% QoQ Net Revenue at INR 9,444 crore, up by 5% QoQ EBITDA at INR 1,097 crore, up by 16% QoQ PAT at INR 659 crore, up by 19% QoQ Standalone performance in Financial Year 2022-23: Sales Volume at 1,764,405 MT Net Revenue at INR 35,030 crore EBITDA at INR 3,567 crore PAT at INR 2,014 crore Net debt at INR 2,591 crore Net debt-to-equity ratio at ~0.2 |

Gurugram, May 17, 2023: Board of Directors of Jindal Stainless Limited (JSL) announced the Q4FY23 and Financial Year 2022-23 financial results today. With revocation of export duty, the Company ramped up export sales in Q4FY23 and consequently delivered the highest-ever quarterly sales volume of 507,632 MT. The Company’s Q4FY23 standalone Net Revenue, EBITDA, and PAT were recorded at INR 9,444 crore, INR 1,097 crore, and INR 659 crore respectively. Net debt in the financial year stood at INR 2,591 crore and the net debt-to-equity ratio improved to ~0.2, despite completion of organic CapEx.

Jindal Stainless posted a robust performance in Q4FY23 on the back of growing end-user industry demand in the domestic market. The core strengths of Jindal Stainless – agility in sales and operations planning, extensive use of digitisation for faster and more efficient decision-making across the value chain (from sourcing to sales and delivery), a dynamic product mix, and R&D-powered product development based on market requirements – remained the key reasons behind this performance.

Subsidised and substandard foreign imports continued to distort the level playing field against Indian manufacturers, especially MSME producers. Specifically, imports from China and Indonesia witnessed a steep increase of 318% and 158% respectively from FY21 to FY23. After a detailed sunset review (SSR) investigation under these challenging circumstances, the Directorate General of Trade Remedies (DGTR) has recommended continuation of the 18.95% Countervailing Duty (CVD) on 200 Series of stainless steel flat products from China.

Financial Performance Summary (Figures in INR crore):

| Particulars | Standalone | |||||

|---|---|---|---|---|---|---|

| Q4FY23 | Q3FY23 | Change | FY23 | FY22 | Change | |

| SS Sales Volume (MT) | 507,632 | 467,879 | 8% | 1,764,405 | 1,670,618 | 6% |

| Net Revenue | 9,444 | 9,001 | 5% | 35,030 | 32,292 | 8% |

| EBITDA | 1,097 | 947 | 16% | 3,567 | 4,720 | (24)% |

| PAT | 659 | 552 | 19% | 2014 | 2790 | (28)% |

| Particulars | Consolidated | |||||

| Q4FY23 | Q3FY23 | Change | FY23 | FY22 | Change | |

| Net Revenue | 9,765 | 9,063 | 8% | 35,697 | 32,733 | 9% |

| EBITDA | 1,144 | 868 | 32% | 3,586 | 5,090 | (30)% |

| PAT | 716 | 513 | 40% | 2,084 | 3,109 | (33)% |

Other key developments:

- Final Dividend: Today, the Board of Directors (BoD) of Jindal Stainless recommended a Final Dividend payment @Re 1.50 for FY23 to the shareholders on account of improved financial performance, taking the total dividend payment to Re 2.50 i.e. 125% per equity share with a face value of Rs 2 each. This announcement comes a month after the BoD approved a Special Interim Dividend payment @Re 1 per equity share for FY23 on successful completion of the merger.

- Expansion updates:

- Brownfield projects: Stainless steel melt shop capacity expansion of 1 million tonne was completed in March 2023, along with the expansion of supporting downstream facilities in Jajpur, taking the total melt capacity of the Company to 2.9 million tonnes per annum within the committed timelines.

- Stake acquisition in NPI facility: Jindal Stainless entered into a collaboration agreement with New Yaking Pte Ltd for a 49% stake in their Nickel Pig Iron (NPI) smelter facility in Indonesia. This first-of-its-kind move by an Indian entity will ensure long-term availability of nickel ore for the Company.

- Rathi Super Steel Ltd: After the successful acquisition of Rathi Super Steel Ltd, Jindal Stainless has begun production in the facility ahead of the planned timelines. This was achieved despite the facility being closed for an extended period of time. Strengthening the Company’s solution-oriented approach and widening its product offerings, this move will add Long Products like wire rods and rebars to the Company’s existing product portfolio.

- JSL-JSHL merger and JUSL acquisition: The merger of Jindal Stainless (Hisar) Limited with Jindal Stainless Limited was completed in FY23. Acquisition of 74% holding of JUSL by JSL is also progressing as planned. This will be completed within the committed timelines, post which, JUSL will become a 100% owned subsidiary of JSL.

- Sustainability and ESG update: Furthering its commitment to reduce its carbon footprint, Jindal Stainless plans to install two rooftop solar plants of 21 Megawatt Peak (MWp) capacity and 6 MWp capacity at its Jajpur and Hisar units respectively. The Company achieved a reduction of ~2.4 lakh tons CO2e in the last two fiscals (FY22 and FY23).

- MoU with CII for National Mission on Corrosion Management: Jindal Stainless signed an MoU with Confederation of Indian Industries (CII) to help scale up the corrosion mitigation movement in India, and improve the life expectancy, safety, and reliability of public infrastructure.

- Sponsorship of India’s first north-eastern half-marathon series: Jindal Stainless collaborated with Northeast Frontier Railways (NFR) to be the title sponsor for north-east India’s first half marathon series, the JSL NFR Northeast Half Marathon. The events were hosted in Guwahati on February 5 and in Darjeeling on February 26.

- Supply to Mumbai Metro Line: Jindal Stainless supplied stainless steel for the outer panel, car body, structurals, roof, interiors, under-frame, and other stainless steel applications for the newly-launched Phase 2 of the Mumbai Metro Line 2A and 7. The line was inaugurated by the Hon’ble Prime Minister, Mr Narendra Modi, in Mumbai on January 19, 2023.

Despite challenging macro-economic developments on a YoY basis, Jindal Stainless’ standalone sales volume and Net Revenue stood at 1,764,405 metric tonnes and INR 35,030 crore, up by 6% and 8% over FY22 respectively. EBITDA and PAT of the Company were recorded at INR 3,567 crore and INR 2,014crore respectively in the same period. During FY23, JSL’s consolidated Net Revenue, EBITDA and PAT stood at INR 35,697 crores, INR 3,586 crores and INR 2,084 crores, respectively.

Management Comments:

Commenting on the performance of the Company, Managing Director, Jindal Stainless, Mr Abhyuday Jindal said, “With the completion of the merger of JSHL into JSL, capacity expansion and diversification acquisition, the last financial year has been historic for Jindal Stainless. We’re also proud to be chosen for the pilot of the ‘Make in India’ branding of steel and stainless steel products for exports from the country. We are constantly working on being more agile and adaptable to dynamic market conditions and customer requirements, and I’m sure that this strategy will continue to serve us well in the future. As a responsible corporate committed to its ESG goals, we are making focussed efforts to reduce our carbon footprints and increase consumption of renewable energy. It is noteworthy that we achieved a reduction of nearly 2.4 lakh tons of carbon emissions in the last two financial years. ”

About Jindal Stainless

Founded in 1970, Jindal Stainless has recorded a turnover of US $4.20 bn (FY22). It has two stainless steel manufacturing complexes in India, in Hisar, Haryana and Jajpur in Odisha, as well as an overseas manufacturing unit in Indonesia. Besides, it has six service centres in India and one in Spain. It also has a worldwide network of 14 offices and 10 sales offices in India. The Company’s product range includes stainless steel slabs, blooms, coils, plates, sheets, precision strips, blade steel and coin blanks.