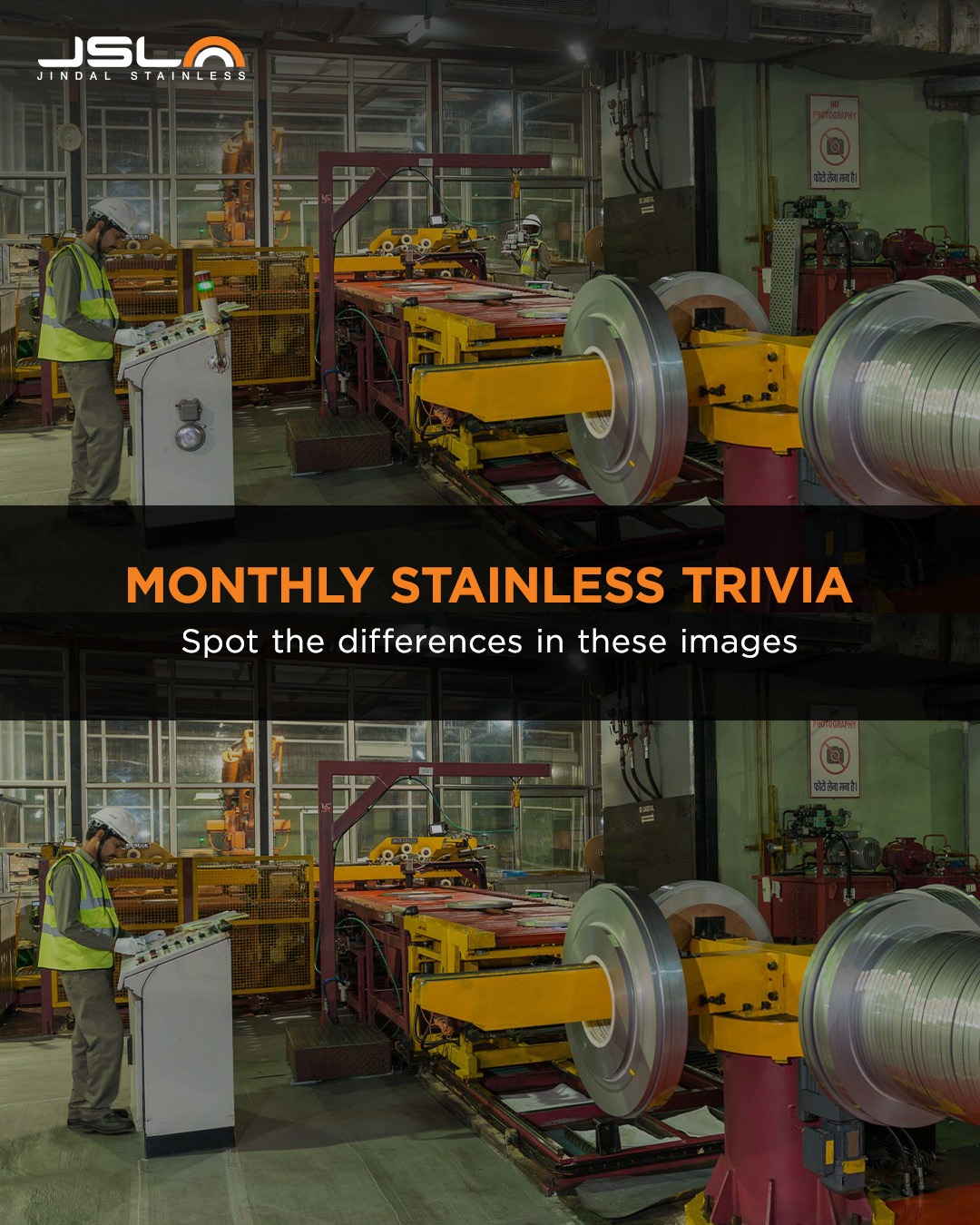

Monthly

Stainless Trivia

Fill in your answer below

Jindal Stainless (Hisar) Limited posts revenue and production growth in

Q2FY19

| Particulars | Q2 FY18-19 | Q1 FY18-19 | Change |

|---|---|---|---|

| Net Revenue | 2,229 | 2,133 | 5% |

| EBIDTA | 230 | 252 | -9% |

| PAT | 62 | 79 | -22% |

New Delhi, 30th October, 2018: The unaudited financial results of Q2 and H1 FY19 were taken on record by the Board of Directors of Jindal Stainless (Hisar) Limited (JSHL) here today. The production volumes for Q2 stood at 0.17 MT (million tons), registering an increase of 6% over the previous quarter. The company witnessed an increase of 5% in revenue, up from Rs 2,133 crore in Q1FY19 to Rs 2,229 crore in Q2FY19. Sharing his views on the performance of the quarter, Managing Director, JSHL, Abhyuday Jindal, said, “Our sustained focus on downstream value addition has enabled us to report a 10% growth in the production output of the Specialty Products Division. This helped offset the impact of fluctuations in raw material prices. Along with catering to the specialised needs of railways, automobiles and other sectors, we are focusing on expanding the use of stainless steel in long products, and other applications such as roofing and solar power generation equipment. This, along with our consistent operational performance, has helped us register a PAT of Rs. 62 crores in Q2FY19. This is despite the unfavourable macro-economic situation faced by the stainless steel industry in India”.

The domestic stainless steel industry is battling the onslaught of imports from countries like China, Japan and Korea. These countries, riddled with excess capacities, route their surplus production to India through Free Trade Agreements (FTAs) countries like Indonesia, and circumvent Countervailing Duty and Anti-Dumping Duty imposed by the Indian government. Adding to the problem is duty inversion arising from the fact that finished goods are imported duty-free from FTA countries like Japan and Korea, whereas key raw materials for stainless steel manufacturing, stainless steel scrap and ferro nickel, attract import duty despite not being available in India. This is creating huge trade imbalances for domestic players and widening India’s trade deficit with other countries. Basic custom duty (BCD) imposed on carbon steel goods stands at 12.5%, as opposed to the corresponding figure for stainless steel at only 7.5%. This combination of import duties on raw materials, low levels of protection in terms of BCD, and duty inversion related to FTAs places the domestic industry at a strategic disadvantage. Trade protectionist measures adopted by US, EU and China are adding to this pressure. Support from the government is quintessential for the Indian stainless steel players to compete with global manufacturers on a level playing field and to meaningfully contribute to the ‘Make in India’ mandate.

| Particulars | H1FY18-19 | H1FY17-18 | Change | Q2FY18-19 | Q2FY17-18 | Change |

|---|---|---|---|---|---|---|

| Net Revenue | 4,363 | 4,566 | -4% | 2,229 | 2,348 | -5% |

| EBIDTA | 481 | 528 | -9% | 230 | 277 | -17% |

| PAT | 141 | 166 | -15% | 62 | 92 | -33% |

In H1FY19, the production volume stood at 0.33 MT, down by 5% Y-o-Y, due to maintained emphasis on increased production of niche and value added products during the first half of H1FY19. The upward trend of power and fuel costs, clubbed with steep increase in prices of electrodes, led to an impact on the net revenue and EBIDTA of the company, during both Q2 and H1 FY19. EBIDTA per ton in Q2FY19 was maintained at the same level as corresponding period last year on account of increased proportion of value added mix in the product basket.

In a notable development during the quarter, JSHL contributed its material to the first prototype of the world class Train 18, manufactured at Integral Coach Factory, Chennai. Train 18, the first engine-less stainless steel-made train set, is set to replace Shatabdis in a phased manner. This exemplifies the benefits offered by stainless steel over carbon steel in terms of improved strength, longevity, impact & temperature resistance, and lower lifecycle costs.

JSHL also secured approvals from Norsok and EIL to produce duplex grades, which are preferred for use in oil & gas, chemical, power, petrochemical etc. and other demanding industries. CARE rating upgrade of JSHL to ‘A-’ was another significant occurrence in the quarter.