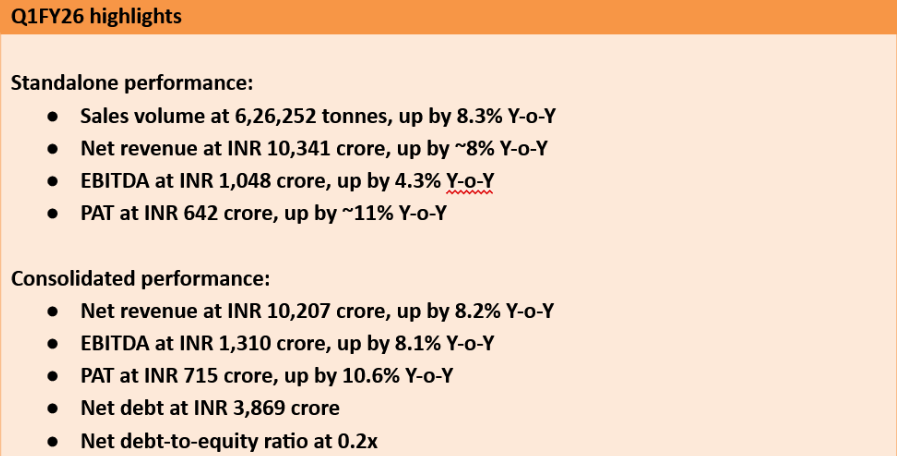

New Delhi, August 6, 2025: The Board of Directors of Jindal Stainless Limited (JSL) today announced the financial results for the quarter ended on June 30, 2025. The company recorded a sales volume of 6,26,252 tonnes, up by 8.3% on a year-on-year (Y-o-Y) basis. The company’s Q1FY26 standalone net revenue was recorded at INR 10,341 crore, up by ~8% on a Y-o-Y basis. Standalone EBITDA and PAT stood at INR 1,048 crore and INR 642 crore, both up by 4.3% and ~11% Y-o-Y, respectively. The consolidated net revenue was at INR 10,207 crore, up by 8.2% Y-o-Y. The EBITDA was recorded at INR 1,310 crore and PAT was at INR 715 crore, up by 8.1% and 10.6% Y-o-Y respectively. The consolidated net debt was at INR 3,869 crore, while the net debt-to-equity ratio was at 0.2x.

The company’s agility in balancing demand across domestic and export markets, its focus on product innovation across sectors – including increased emphasis on value-added segments and downstream offerings – and improved operational efficiencies have enabled it to deliver a sustained performance.

The domestic market demonstrated steady growth in the first quarter, supported by robust demand from key sectors such as automotive, metro, white goods, and lifts and elevators on a quarter-on-quarter (Q-o-Q) basis. With the government’s increased focus on strengthening inter- and intra-city transit networks, stainless steel demand for metro remained firm. The rising urbanisation and infrastructure development led to a strong performance in the lifts and elevators segment, positioning the company well in this segment for the year ahead. The company’s co-branding scheme, ‘Jindal Saathi Seal’ strengthened partner confidence through a shared commitment to quality and authenticity. Initially launched in the pipes and tube segment, it was also extended to kitchenware and sinks category, assuring excellence for the customers. Initiatives like the QR Code Loyalty Program further boosted customer engagement and operational agility.

On the export front, geopolitical uncertainties and protectionist measures in key geographies such as the EU and the US continued to weigh on global trade sentiment. Despite these external challenges, the company was able to maintain the export sales volume. This was driven by a strong focus on strategically serving global customers and providing value-added solutions tailored to their needs. The company will continue to explore potential export opportunities in line with its strategic goals.

Domestic/export mix in total sales

| Geographical segment | Q1FY26 | Q4FY25 | Q1FY25 |

| Domestic | 91% | 92% | 90% |

| Export | 9% | 8% | 10% |

Financial performance summary (figures in INR crore)

| Particulars | Standalone | ||||

| Q1 FY26 | Q4 FY25 | Change (Q-O-Q) | Q1 FY25 | Change (Y-O-Y) | |

| SS Sale Volume (MT) | 6,26,252 | 6,42,641 | -2.6% | 5,78,143 | 8.3% |

| Net Revenue | 10,341 | 10,786 | -4.1% | 9,585 | 7.9% |

| EBITDA | 1,048 | 890 | 17.7% | 1,004 | 4.3% |

| PAT | 642 | 925 | -30.6% | 578 | 10.9% |

| Particulars | Consolidated | ||||

| Q1 FY26 | Q4 FY25 | Change (Q-O-Q) | Q1 FY25 | Change (Y-O-Y) | |

| Net Revenue | 10,207 | 10,198 | 0.1% | 9,430 | 8.2% |

| EBITDA | 1,310 | 1,061 | 23.5% | 1,212 | 8.1% |

| PAT | 715 | 590 | 21.1% | 646 | 10.6% |

Other key developments:

- R&D

- Jindal Stainless manufactured and dispatched its first commercial batch of 9Cr1Mo plate – produced for the first time in India – to Bharat Heavy Electricals Limited (BHEL) for use in steam generator applications.

- Jindal Stainless successfully completed the export supply of its new martensitic grade 1.4110, developed for knife application.

- The company manufactured a high Nickel 304 grade with restricted ferrite content for Larsen & Toubro (L&T) for structural applications.

- Sustainability and ESG

- Jindal Stainless’ corporate office in Gurugram was awarded the Platinum Certification under the LEED v4.1 Operations and Maintenance: Existing Buildings by the U.S. Green Building Council (USGBC). The certification reaffirmed the company’s commitment to sustainability, energy efficiency, water conservation, indoor air quality, and green operations at the workplace.

- As part of World Environment Day, the company conducted the fourth edition of its annual plastic waste collection drive across its corporate offices and manufacturing facilities in Jajpur, Odisha, and Hisar, Haryana. The initiative was extended to communities surrounding both plants for the first time. The collective efforts led to a collection of ~13.5 tonnes of plastic waste.

- Other developments

- Jindal Stainless successfully supplied high-strength stainless steel for the Indore Metro’s Super Priority Corridor, an infrastructure project designed to transform urban mobility.

- Jindal Stainless’ strategic arm, Jindal Defence and Aerospace (JDA), successfully substituted a super alloy with a high-performance stainless steel grade for use in Solid Oxide Fuel Cells (SOFCs), enabling material innovation for clean energy applications.

- Defence

- JDA supplied stainless steel grade strips for border fencing applications of the Indian Armed Forces.

- JDA also delivered low-alloy steel sheets for motor casings used in anti-tank guided missiles.

- Category awareness and skill development initiatives via Stainless Academy, partnerships, and advocacy

- Jindal Stainless expanded its skill development efforts through Stainless Academy. The effort included training fabricators pan India and organising industrial training programmes across key sectors such as pharmaceuticals, oil and gas, automotive, and industrial fabrication. In Q1FY26, over 3,000 fabricators were trained on the properties and applications of stainless steel and industry knowledge, taking the total number of trained fabricators to over 53,000 to date.

- Jindal Stainless applied for National Council for Vocational Education and Training (NCVET) Awarding Body Status under the ‘Leading Indian Enterprise’ category, aiming to become India’s leading certifier for stainless steel courses. With government accreditation, Jindal Stainless will offer nationally organised certifications across its reskilling and upskilling programmes.

- Jindal Stainless partnered with MIT World Peace University, Pune, to offer a course on sustainable stainless steel applications in tunnel engineering within the MTech Civil Engineering programme.

- Strengthening cybersecurity and enabling digital manufacturing

- Jindal Stainless achieved ISO/IEC 27001:2022 certification in May 2025, demonstrating its commitment to global standards in information security. This milestone reinforces a proactive approach to managing cybersecurity risks across the organisation.

- The company launched Project Pragati at its Hisar plant, aimed at revolutionising the production planning and execution processes, by integrating Dassault Apriso MES with Quintiq Advanced Planning System – a first in the stainless steel industry. This smart manufacturing initiative is expected to reduce lead times by 10–15%, optimise inventory by 8–10%, and enhance customer experience with real-time order visibility.

- Awards and recognitions

- The company’s Jajpur unit won the commendation for significant achievement in Environment Management (Manufacturing sector) by CII – ITC Centre of Excellence.

- Jindal Stainless was recognised for the third consecutive year at the National Awards for Manufacturing Competitiveness (NAMC), receiving the prestigious Diamond Trophy. Our Hisar unit also received the ‘Excelsior’ Aatma Nirbhar Nation Builder Award, following three successive wins in the standard category.

- The company’s Hisar unit was recognised as the ‘Sustainable Organisation of the Year’ at the 5th Edition of the Sustainability Summit & Awards 2025, organised by UBS Forums.

- The company’s Jajpur unit has won the ‘Best ESG Performance award in Decarbonisation’ by Transformance.

Management Comments:

Commenting on the performance of the company, Managing Director, Jindal Stainless, Mr Abhyuday Jindal, said, “Despite continued volatility in the global landscape, Jindal Stainless has reinforced its market leadership underpinned by our customer-centric approach, sustained product and special grades innovation, and continued operational efficiency. We are advancing our presence across high-impact sectors such as railways, automotive, and infrastructure, while unlocking new opportunities across the sectors through strategic partnerships and application-driven offerings. Our initiatives like co-branding programmes and loyalty schemes are redefining customer engagement and operational agility. As stainless steel gains recognition as the material of choice for nation-building, the need for a dedicated national stainless steel policy becomes increasingly imperative.”

About Jindal Stainless

India’s leading stainless steel manufacturer, Jindal Stainless, had an annual turnover of INR 40,182 crore (USD 4.75 billion) in FY25 and is ramping up its facilities to reach 4.2 million tonnes of annual melt capacity in FY27. It has 16 stainless steel manufacturing and processing facilities in India and abroad, including in Spain and Indonesia, and a worldwide network in 12 countries, as of March 2025. In India, there are ten sales offices and six service centres, as of March 2025. The company’s product range includes stainless steel slabs, blooms, coils, plates, sheets, precision strips, wire rods, rebars, blade steel, and coin blanks.

Jindal Stainless relies on its integrated operations to enhance its cost competitiveness and operational efficiency. Founded in 1970, Jindal Stainless continues to be inspired by a vision for innovation and enriching lives and is committed to social responsibility.

Jindal Stainless remains focused on a greener and sustainable future. The company manufactures stainless steel using an electric arc furnace, a process that significantly reduces greenhouse gas emissions and allows for recyclability of scrap without compromising on quality.