Monthly

Stainless Trivia

Fill in your answer below

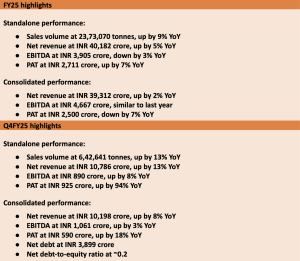

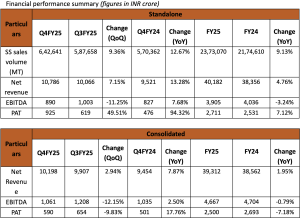

New Delhi, May 8, 2025: The Board of Directors of Jindal Stainless Limited (JSL) today announced the financial results for the quarter and financial year ended on March 31, 2025. The company recorded sales at 23,73,070 tonnes, a jump of 9% over FY24. On a standalone basis, net revenue rose by 5% YoY, at INR 40,182 crore. In FY25, EBITDA was recorded at INR 3,905 crore, down by 3% over last year, and PAT at INR 2,711 crore, showcasing a growth of 7% YoY.

Backed by continued and strong domestic demand, sales volume in Q4FY25 grew to the highest-ever 6,42,641 tonnes, up by 13% on a YoY basis. While the net standalone revenue rose by 13% to INR 10,786 crore, EBITDA also increased by 8% compared to Q4FY24. However, PAT registered an impressive growth of 94% over last year.

In FY25, the domestic demand for stainless steel grew. The government’s efforts to promote stainless steel usage along India’s 7,500 km coastline enhanced market awareness and encouraged material substitution. Stainless steel continued to gain traction in the logistics sector, with growing applications in electric vehicles, trailers, and containers—many of which are already in active use, with further projects in development. The automotive, railway coach, metro, white goods, and pipes and tubes sectors saw double-digit growth, while the speciality grade segment also recorded stable growth QoQ. Furthermore, critical sectors, such as process, hydrogen, and nuclear industries, demonstrated significant growth potential in FY25, opening up new avenues for business development.

The Board of Directors of JSL recommended a final dividend payment of INR 2 for FY25 subject to approval of shareholders, taking the total dividend payment to INR 3 i.e. 150% per equity share with a face value of INR 2 each. Consolidated net debt as on March 31, 2025, stood at INR 3,899 crore. The consolidated net debt-to-equity ratio was largely maintained at ~0.2, despite a capex-heavy year.

On the global front, the recent geopolitical trade situation caused worldwide volumes to decline in this quarter, negatively impacting overall international trade. Despite this, Jindal Stainless continued to serve customers across the globe by capitalising on market opportunities and value-added offerings. In Q4 FY25, export demand began to rise once more, which was fulfilled by ramping up capacity utilisation. This is projected to continue improving in the short and mid-term, especially in quality-conscious markets like the US and EU.

Domestic/export mix

| Geographical Segment | Q4FY25 | Q4FY24 | FY25 | FY24 |

| Domestic | 92% | 89% | 91% | 87% |

| Export | 8% | 11% | 9% | 13% |

Chinese and Vietnamese imports continued to challenge India’s stainless steel industry, accounting for over 70% of total imports in this fiscal, with low-priced stainless steel often rerouted through ASEAN countries, including Vietnam. While FY25 saw a 7% YoY rise in imports from China, imports from Vietnam surged by 176% in FY25 and by 64% in Q4FY25 over their respective periods, reflecting continued circumvention practices.

Other key developments:

- Strategic stake in M1xchange

Jindal Stainless, along with its subsidiary Jindal Stainless Steelway Ltd., acquired a 9.62% stake in M1xchange—India’s leading TReDS platform licensed by the RBI. This strategic investment will support JSL’s broader digitalisation goals by simplifying payment systems, paving the way for cheaper credit access for its entire global value

chain, including the deep-tier channel, while reducing working capital cycles, and improving operational efficiency.

- Proposed investment in Maharashtra

Recently, JSL signed a non-binding MoU with the Maharashtra government with a possibility of an INR 40,000 crore investment in the state to set up a stainless steel manufacturing facility. The proposed facility is scheduled to be developed over the next 10 years, which is expected to create more than 15,000 jobs.

- Jindal Defence and Aerospace1. JSL’s strategic arm, Jindal Defence and Aerospace (JDA), has successfully supplied low-alloy steel sheets to Brahmos Aerospace for the missile carrier application and achieved a significant milestone by meeting Brahmos’ stringent quality requirements.

2. JDA secured its inaugural commercial contract from KS Engineering for a project in which Bharat Electronics Limited will use its material in sensor plate applications.

- Sustainability and ESG

- Corporate Carbon Footprints were reduced by ~15% in FY25, achieved through ongoing decarbonisation initiatives.

- Jindal Stainless published its first Taskforce on Nature-related Financial Disclosure (TNFD) Report in FY25, the first of its kind in the Indian iron and steel sector.

- Recently, JSL’s subsidiary, JSL Super Steel, also signed an 11 MWp long-term Power Purchase Agreement (PPA) with Sunsure Energy, a leading independent power producer. This will help JSL Super Steel to displace nearly 40% of its conventional energy consumption with clean power, offsetting nearly 12 million kilograms of carbon emissions annually.

- Jindal Stainless has installed Odisha’s largest captive solar plant inside a manufacturing plant at its Jajpur unit in collaboration with AB Energia. This advanced plant, generating 44.3 million units of green energy annually, comprises of a 7.324 MWp floating solar plant alongside a 23.02 MWp rooftop solar system. This green energy is sufficient to power between 12,000 and 15,000 households or prevent the annual release of 32,208 metric tonnes of CO2.

Management Comments:

Commenting on the performance of the company, Managing Director, Jindal Stainless, Mr Abhyuday Jindal, said, “The past financial year has been a defining chapter in our mission to bolster our leadership in the domestic market and ensure our supply chain excellence. The early commissioning of our NPI facility in Indonesia, the full acquisition of Chromeni Steels to enhance the proportion of our cold rolled products, and our strategic investment in M1xchange have all strengthened our value chain from end to end, ensuring raw material security, product diversification, and a bold step toward digital leadership. As we accelerate green hydrogen adoption, innovate new products and grades for sustainable logistics, infrastructure and industries, scale renewable energy supply, and lead with transparent ESG disclosures, we are not just focused on manufacturing stainless steel, but also forging a wholesome, tech-enabled, and Atmanirbhar future for India.”

About Jindal Stainless

India’s leading stainless-steel manufacturer, Jindal Stainless, had an annual turnover of INR 40,182 crore (USD 4.75 billion) in FY25 and is ramping up its facilities to reach 4.2 million tonnes of annual melt capacity in FY27. It has 16 stainless steel manufacturing and processing facilities in India and abroad, including in Spain and Indonesia, and a worldwide network in 12 countries, as of March 2025. In India, there are ten sales offices and six service centres, as of March 2025. The company’s product range includes stainless steel slabs, blooms, coils, plates, sheets, precision strips, wire rods, rebars, blade steel, and coin blanks.

Jindal Stainless relies on its integrated operations to enhance its cost competitiveness and operational efficiency. Founded in 1970, Jindal Stainless continues to be inspired by a vision for innovation and enriching lives and is committed to social responsibility.

Jindal Stainless remains focused on a greener and sustainable future. The company manufactures stainless steel using electric arc furnace, a process that significantly reduces greenhouse gas emissions and allows for recyclability of scrap without compromising on quality.