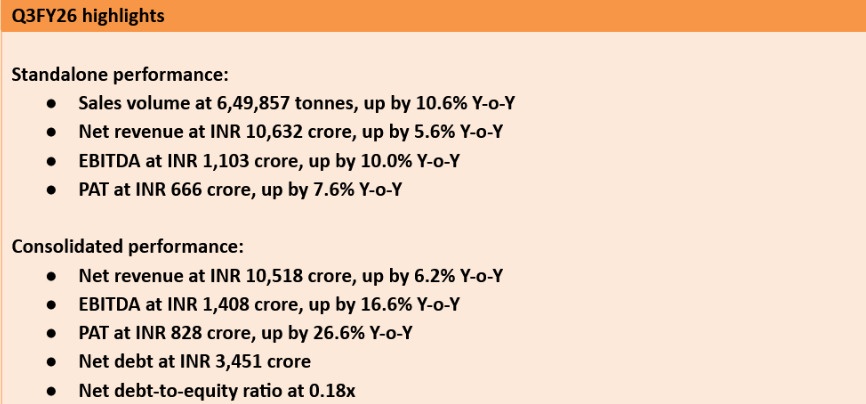

New Delhi, January 21, 2026: The Board of Directors of Jindal Stainless Limited (JSL) today announced the company’s financial results for the quarter ended December 31, 2025. The company recorded a sales volume of 6,49,857 tonnes, up by 10.6% on a year-on-year (Y-o-Y) basis, while standalone net revenue stood at INR 10,632 crore, up by 5.6% on a Y-o-Y basis. Standalone EBITDA and PAT stood at INR 1,103 crore and INR 666 crore, reflecting a Y-o-Y growth of 10% and 7.6% respectively. The consolidated net revenue was at INR 10,518 crore, up by 6.2% Y-o-Y. Consolidated EBITDA was recorded at INR 1,408 crore and PAT at INR 828 crore, up by 16.6% and 26.6% Y-o-Y respectively. The consolidated net debt was at INR 3,451 crore, while the net debt-to-equity ratio of 0.18x.

The Board of Directors also approved payment of interim dividend @50% i.e. INR 1 per equity share (face value of INR 2 each) for FY26. The record date for determining the entitlement of members for the purpose of payment has been set as January 29, 2026. The dividend shall be paid on or before February 19, 2026.

The company delivered a sustained performance, driven by its innovative product offerings, improved operational efficiency, and enhanced customer service. In the domestic market, JSL maintained steady momentum during the quarter, underpinned by consistent demand from key sectors such as automotive, ornamental pipes and tubes, railways & metro, and white goods, amid factors including a growing focus on infrastructure expansion, efficient vertical transportation, and strengthened transit networks. Misuse of FTA routes allowed a surge of imports from China and other ASEAN countries like Vietnam, leading to continued dumping of substandard, subsidised, and low-priced imports coming into the country and distorting the level-playing field, particularly for Indian MSMEs. Despite this, Jindal Stainless retained its market share through its competitive pricing, robust distribution network, and customer-focused initiatives such as Jindal Saathi Seal and QR Code and Loyalty incentive program.

On the export front, global trade sentiments remained subdued due to elevated uncertainties and protectionist measures in key western markets, particularly the United States and the European Union. In response, the company continued to strategically prioritize the domestic market while moderating export volumes, with a focus on providing value-added solutions tailored to the needs of its long-term global customers.

Domestic/export mix in total sales

| Geographical segment | Q3 FY26 | Q2 FY26 | Q3 FY25 |

| Domestic | 94.6% | 91.4% | 91.5% |

| Export | 5.4% | 8.6% | 8.5% |

Financial performance summary (figures in INR crore)

| Particular | Standalone | |||||||

| Q3 FY26 | Q2 FY26 | Change (Q-O-Q) | Q3 FY25 | Change (Y-O-Y) | 9M FY26 | 9M FY25 | Change | |

| SS Sale Volume (MT) | 6,49,857 | 6,48,050 | 0.3% | 5,87,658 | 10.6% | 19,24,159 | 17,30,428 | 11.2% |

| Net Revenue | 10,632 | 10,881 | -2.3% | 10,066 | 5.6% | 31,854 | 29,396 | 8.4% |

| EBITDA | 1,103 | 1,060 | 4.1% | 1,003 | 10.0% | 3,211 | 3,015 | 6.5% |

| PAT | 666 | 644 | 3.4% | 619 | 7.6% | 1,951 | 1,786 | 9.2% |

| Particular | Consolidated | |||||||

| Q3 FY26 | Q2 FY26 | Change (Q-O-Q) |

Q3 FY25 | Change (Y-O-Y) |

9M FY26 | 9M FY25 | Change | |

| Net Revenue | 10,518 | 10,893 | -3.4% | 9,907 | 6.2% | 31,617 | 29,114 | 8.6% |

| EBITDA | 1,408 | 1,388 | 1.4% | 1,208 | 16.6% | 4,106 | 3,606 | 13.9% |

| PAT | 828 | 808 | 2.5% | 654 | 26.6% | 2,350 | 1,910 | 23.0% |

Key developments

- Marketing and branding

- Expanded the co-branding initiative, Jindal Saathi Seal, in stainless steel kitchenware and sinks to 20 partners, taking the total number of partners covered under this program (including for Pipe and Tubes segment) to 170.

- Scaled the Jindal Saathi Pragati Loyalty Program to over 5,400 retailers and 39,000 fabricators by this quarter, driving a 400% surge in QR code scanning to 4+ lakh scans per month.

- Sustainability and ESG

- Achieved an S&P Global Corporate Sustainability Assessment score of 78/100, ranking among the top 5% in the steel sector and securing 4th position globally as of 26th Nov’2025.

- Received an ESG rating of 71/100 from SEBI registered ESG Rating Provider (ERP) – NSE Sustainability Ratings and Analytics Limited, making JSL one of the highest scored companies in the Indian ‘Iron and Steel’ sector for its sustainability excellence.

- Renewable power as a percentage of total imported power utilized across our Jajpur and Hisar facilities was at 56% in Q3 FY26, marking a significant step toward cleaner and more sustainable operations.

- Published four Environmental Product Declarations (EPDs) which has been featured in the public EPD library.

- Other developments

- Deployed advanced 304 & JT (N7 as per BIS 6911 specifications) grades of stainless steel, known for their superior corrosion resistance, fire resistance, and higher strength and excellent impact, for the pioneering Salt Tipper Trailer, a breakthrough in sustainable logistics

- Unveiled the company’s first Stainless Steel fabrication unit in Mumbai, for fabrication of critical components, including bridge girders among others, supporting world-class infrastructure development in India.

- Jindal Stainless’ strategic arm, Jindal Defence and Aerospace (JDA) secured orders for special alloy plates for India’s first manned spaceship – Gaganyaan, marking its entry into human-rated, stringent-quality material supply chains.

- JDA started Electro slag remelting facility for production of high-performance alloys and steel, further strengthening the position of the company in strategic sector.

- Category awareness, skill development and advocacy initiatives via Stainless Academy

- Trained over 9500 fabricators via the Fabrication Training Programs across India for enhancing awareness and shop-floor competence in stainless steel fabrication, improving process and quality efficiency, and operator-level understanding in the kitchenware and heavy fabrication segments.

- Signed MoU with 04 government ITIs at Bhubaneswar and Rourkela in Odisha, Varanasi in Uttar Pradesh and Mahad, Raigad in Maharashtra, to implement a 155-hours stainless steel Fabrication course in the ITIs.

- Awards and recognitions

- Won the Golden Peacock Award for Sustainability 2025, the only company in the Metal sector to have received it last year.

- Recognized with a 4.75-star rating (out of 5) in the ‘Manufacturing’ Category at the CII Energy Conservation Award (ENCON) 2025 for the Jajpur unit.

- Won the ‘Economic Times Energy Leadership Award 2025’ in the ‘Energy Conservation – Industries’ category for the Hisar unit.

- Recognised as the top performer in ‘Iron & Steel’ sector by Odisha State Energy Conservation Award 2025 for the Jajpur unit.

- Won the ‘State Level Energy Conservation Awards 2024’ by Haryana Renewable Energy Development Agency (HAREDA) for the Hisar Unit.

- Won the ‘Financial Express (FE) Green Sarathi – Sustainable Carbon Reduction’ award for the Hisar Unit.

Management Comments:

Commenting on the performance of the company, Managing Director, Jindal Stainless, Mr Abhyuday Jindal, said, “The domestic market, where we see sustained growth and demand, remains our strategic priority, and we will further intensify efforts to expand our footprint across key sectors with a strong emphasis on innovation. We continue to advocate for robust regulatory framework of standards and QCOs to curb the inflow of substandard imports into the country that risk consumer safety. On the export front, we stay cautiously optimistic. Our long-standing customer relationships and differentiated value-added offerings hold us in good stead, even as we closely monitor evolving tariff clarity and market developments.”

About Jindal Stainless

India’s leading stainless steel manufacturer, Jindal Stainless, had an annual turnover of INR 40,182 crore (USD 4.75 billion) in FY25 and is ramping up its facilities to reach 4.2 million tonnes of annual melt capacity in FY27. It has 16 stainless steel manufacturing and processing facilities in India and abroad, including in Spain and Indonesia, and a worldwide network in 12 countries, as of March 2025. In India, there are ten sales offices and six service centres, as of March 2025. The company’s product range includes stainless steel slabs, blooms, coils, plates, sheets, precision strips, wire rods, rebars, blade steel, and coin blanks.

Jindal Stainless relies on its integrated operations to enhance its cost competitiveness and operational efficiency. Founded in 1970, Jindal Stainless continues to be inspired by a vision for innovation and enriching lives and is committed to social responsibility.

Jindal Stainless remains focused on a greener and sustainable future. The company manufactures stainless steel using electric arc furnace, a process that significantly reduces greenhouse gas emissions and allows for recyclability of scrap without compromising on quality.